So the following is just me trying out my programing skills. So there are sure to be some mistakes. But it looks ok so far.

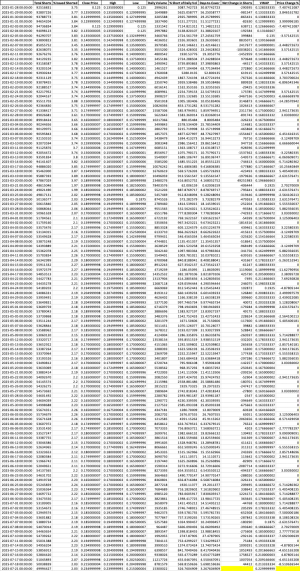

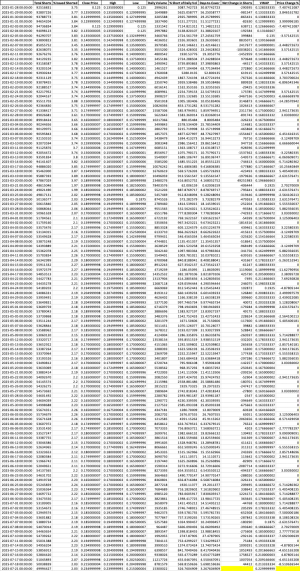

So here is what I could scrape:

So that is the Data.

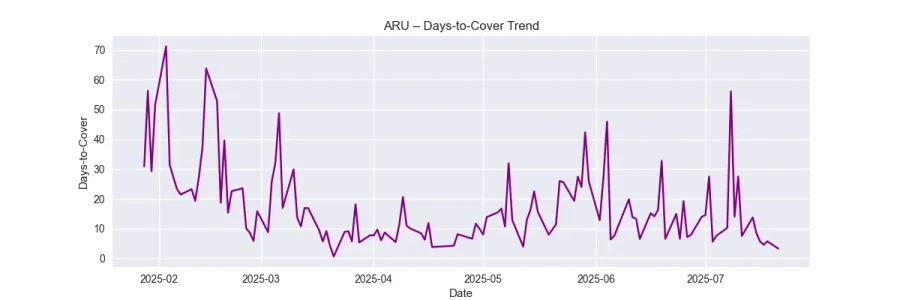

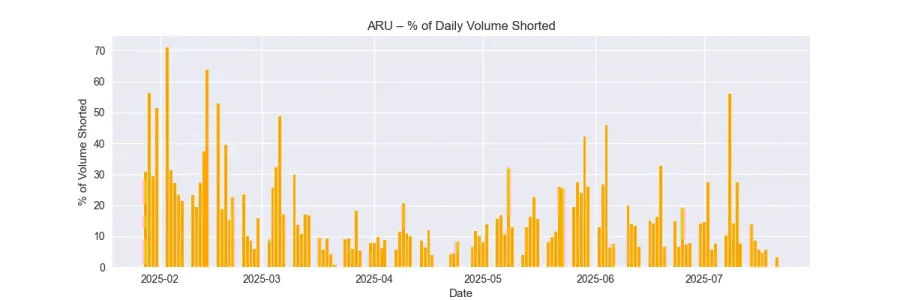

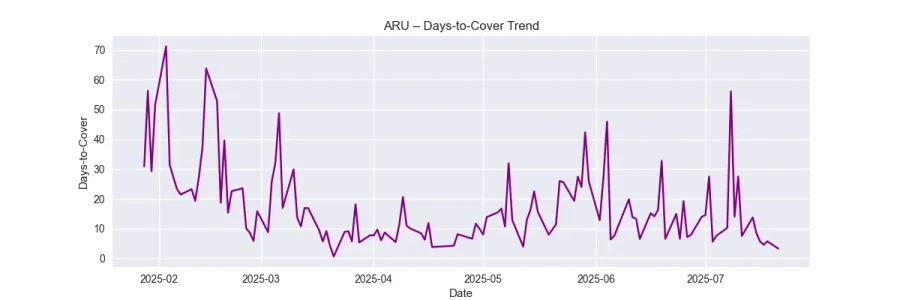

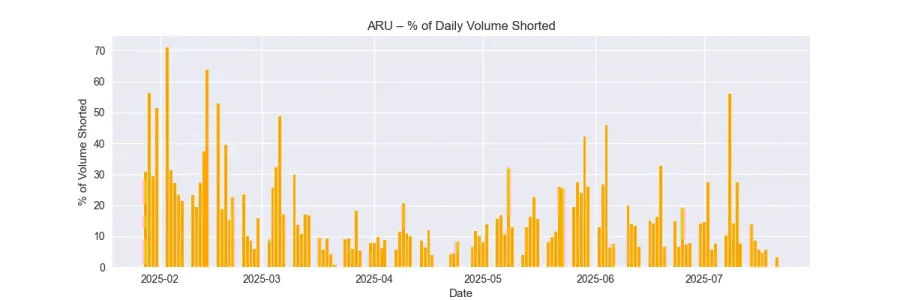

Here are the graphs:

o what does it all mean? Here’s the story that emerges from this dataset:

1. Early Period (Late Jan to Early Feb)

What do you guys think? Seems about right...

So here is what I could scrape:

So that is the Data.

Here are the graphs:

o what does it all mean? Here’s the story that emerges from this dataset:

1. Early Period (Late Jan to Early Feb)

- Price Range: ~0.125 → 0.145

- Short Interest: rising steadily from ~92M to ~95M shares.

- % Issued Shorted: ~3.7–3.8% → moderately high.

- Volume Spikes: occasional high-volume days, with Days-to-Cover (DtC) often >20–50, meaning liquidity was thin relative to the short position.

- Story: Shorts were adding slowly, but the price didn’t collapse. It oscillated within a tight band, suggesting either controlled selling pressure or accumulation from long buyers absorbing supply.

- Feb 6–14: Price tested 0.14–0.15, volumes spiked to 4M+, short interest jumped, but DtC fell as liquidity improved.

- There’s a sharp drop on Feb 19 (~-7% intraday), but it bounced back by Feb 21.

- Narrative: Shorts likely tried to push the price lower, but strong buying supported the stock around 0.14.

- Feb 25–27: Price explodes from 0.15 → 0.175–0.185, and volume surges >15M.

- Shorts covered: net reduction in shorts, dropping from ~95M → ~91M.

- Days-to-Cover plummeted (showing massive liquidity).

- Story: Likely news-driven spike or a short squeeze. Shorts were forced to cover as volume/liquidity surged.

- After peaking ~0.185, the stock retraced to ~0.16–0.17.

- Shorts rebuilt positions, climbing again toward ~94M shares.

- Volume dropped back to 3–5M daily, meaning buying pressure cooled.

- Narrative: Post-news hangover. Traders locked in gains. Shorts took advantage of fading momentum.

- March 20: Volume explodes to 23M+, price pushes to 0.20+, but short interest collapses by ~50% overnight (from ~97M → ~48M).

- Days-to-Cover drops from ~4.1 → 0.6.

- Narrative: MASSIVE short covering day → likely a big catalyst (deal? announcement?) forcing shorts to flee.

- After the big squeeze:

- Shorts stabilize ~50M (only ~2.2% of issued shares).

- Price grinds between 0.18–0.20.

- Volume normalizes, moderate swings but no breakout.

- Narrative: Market digests the news. Shorts are cautious. No new catalyst yet.

- Shorts start creeping back up (~55M by end of June).

- Price stays range-bound 0.16–0.18, suggesting accumulation or quiet selling.

- Narrative: The market has cooled; traders are waiting for the next trigger.

- July 4–21:Price surges again:

- 0.18 → 0.23–0.24.

- Volume rises again (10–15M).

- Shorts drop further (~53M → ~50M → ~49M).

- Narrative: Another bullish wave, possibly second news catalyst → shorts exit gradually.

- Jan–Feb: Steady short build, controlled selling.

- Late Feb: Short squeeze & spike (~0.15 → 0.18+).

- March: Sharp event-driven squeeze (volume 20M+, shorts halve overnight).

- Apr–May: Sideways consolidation, shorts cautious.

- June: Shorts quietly rebuild, price compresses.

- July: Second breakout toward 0.24 with shorts exiting.

- This looks like where shorts try to suppress the price between catalysts.

- Each news/catalyst triggers massive volume, forcing shorts to cover.

- There’s a cyclical patternof:

- Shorts build → price stagnates

- Catalyst arrives → spike → shorts cover → consolidation → repeat.

What do you guys think? Seems about right...