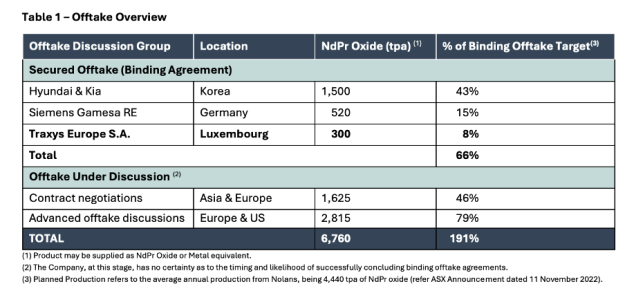

As of March 2025, Arafura has secured multiple offtake agreements to supply Neodymium-Praseodymium (NdPr) oxide from the Nolans Project:

Who else is out there that might want to be an ARU customer for off take?

And who are likely to be customers for our 20% of product (880 t/pa) on the spot market?

- Traxys Europe SA: I think this is a great move by ARU management. I was always concerned that one of our customer cornerstone investors (likely to be Posco) would have too much control over us, and ARU would become beholden to them. But having someone like Traxys, positions us well for Phase 2 off take discussions/negotiations. They were involved in the attempted resurrection of MP Materials around 2010 (from memory). It will be interesting to see if Traxys becomes a middle man between ARU and its customers, or if those customers come direct in the future. Something to keep an eye on.

- Hyundai and Kia: Arafura has established agreements with South Korean automotive manufacturers Hyundai and Kia, further diversifying its customer base and securing demand for its NdPr oxide production. There has been some suggestion that due to the delays, the expiry dates make these non-binding. However, ARU has never said this, and it all its tables for off take, have this as binding. These two EV makers are working with Posco to build supply chains outside of china, and also setting up in USA (and other parts of the world). 10 years ago, these manufacturers had terrible cheap cars. And today, they are great. And they will provide an alterative to the Chinese EVs flooding the world.

- Siemens Gamesa Renewable Energy: An offtake agreement has been signed with Siemens Gamesa to supply NdPr rare earths, highlighting Arafura's role in supporting the renewable energy sector. Even with the ups and downs of renewable energy, these guys sign long term contracts, and need to lock in supply.

- Posco – The Korean steel maker with BIG BIG plans to change supply chains. I personally think, that with all the demand they will see for their magnets, they will need to secure multiple rare earth mine off take from around the world. This also diversifies their supply risk. So I def see them locking in off take with ARU. Also, they have history with investing in Gina’s mines - Gwangyang Lithium Project (through Pilbara Minerals). They have also raise a load of money through bond issues to develop/invest in their strategy. So ARU would only be a small part of this investment.

- USA Dept of Defence – This has always been rumored, but never denied by ARU management. I would imagine that any time of negotiation would require secrecy. But in 2027, all USA military equipment, must be free from China supply. That goes right down to the minerals. Given the time for rare earth mines to come on line into production (15 years plus), where will the USA DoD and it’s contractors, source all this ex-China NdPr. MP won’t be able to do it. Lynas won’t be able to do it. They will need to secure some from each (diversify their ex-China supply). I bet they are stockpiling at the moment. (Aside – remember for the Blackbird, during the cold war, USA managed to get all the Titanium they needed from Russia, through a vast array of fake/real businesses. They should make a movie about it).

- GE – So GE were all set to sign up for binding off take. Then, they decided to split the company into three parts. So all long term contracts etc, were not the priority. Also GE had loads of different types of wind turbines, and some with massive reliability issues that cost them dearly. But they have also restructured their product line (streamlined)…..are they now ready to sign an off take? If they don’t sign for Phase 1 I think they will def be a part of Phase 2. These guys are very much focused on ESG….and where else will they source that?

Who else is out there that might want to be an ARU customer for off take?

And who are likely to be customers for our 20% of product (880 t/pa) on the spot market?