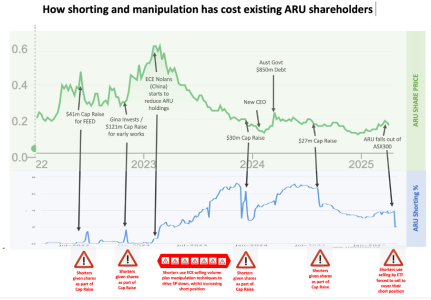

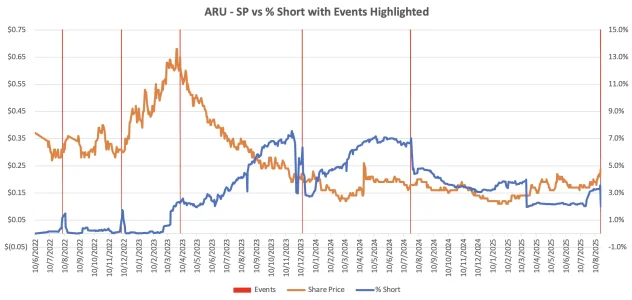

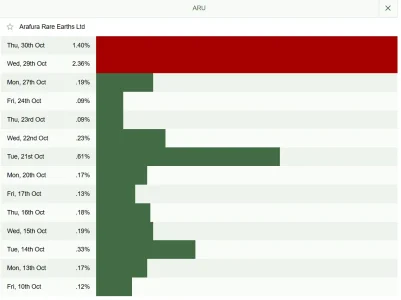

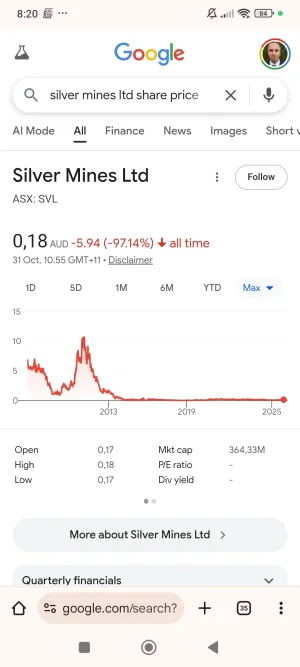

I have been invested in ARU for some time. And there have been many factors at play that have allowed funds to manipulate the share price.

ECE Nolans (The Chinese) Sell down on market

The largest one has been the sell down by ECE Nolans. The ARU board, had tried to do an off market transaction for the full amount. But they declined. So why would they do that? They knew that selling on the market would create massive downward selling pressure….and the SP would go down. A rational investor would not do this. But that is the whole point. They wanted the SP to go down so that is stops investment in ARU and hopefully (for them) stops the mine getting finance and getting into production.

And when all this selling happened, the shorters jumped on. Maybe China through its bank (HSBC who are a major shareholder of ARU) were the ones shorting (off set their losses of selling on the market), but there would have been others.

And this is not even the worst. There is a fox in the ARU hen house….

ARU’S Capital Raises with Canaccord Genuity?

ARU Management used Canaccord Genuity to arrange the Capital Rises on the following:

Now apparently Canaccord Genuity has “Chinese walls” in place to ensure the integrity of its business. Well who is on each board? Hang on, there is zero public information about these separate boards? Maybe because they don’t have them?

In addition, during some of the capital raises, Canaccord Genuity had a SELL/OUTPERFORM rating for ARU. Our own arrangers telling people to sell. It may be legal...maybe....but why keep employing them. If i was any company looking to raise equity....Canaccord Genuity would be at the bottom of the list based on what we have seen on ARU. And ARU management should bequestioned as well. Why do they put up with this?

This is all very fishy.

And when we run it past lawyers, they all run to the hills, because they all have clients that are doing the same thing on other stocks.

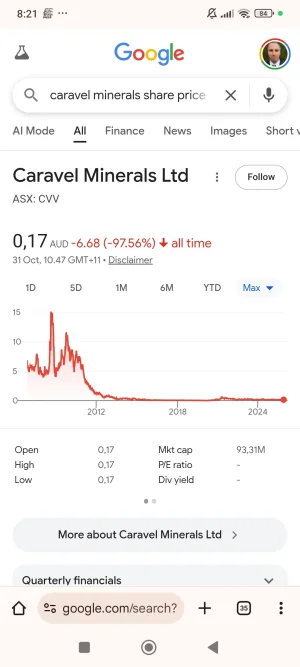

What do others think? Have others seen manipulative trading on ARU? Or any other rare earth stock?

ECE Nolans (The Chinese) Sell down on market

The largest one has been the sell down by ECE Nolans. The ARU board, had tried to do an off market transaction for the full amount. But they declined. So why would they do that? They knew that selling on the market would create massive downward selling pressure….and the SP would go down. A rational investor would not do this. But that is the whole point. They wanted the SP to go down so that is stops investment in ARU and hopefully (for them) stops the mine getting finance and getting into production.

And when all this selling happened, the shorters jumped on. Maybe China through its bank (HSBC who are a major shareholder of ARU) were the ones shorting (off set their losses of selling on the market), but there would have been others.

And this is not even the worst. There is a fox in the ARU hen house….

ARU’S Capital Raises with Canaccord Genuity?

ARU Management used Canaccord Genuity to arrange the Capital Rises on the following:

- Aug 2022 – A$32m Equity Raising: Canaccord Genuity, alongside Bell Potter, facilitated the equity raising for Arafura.

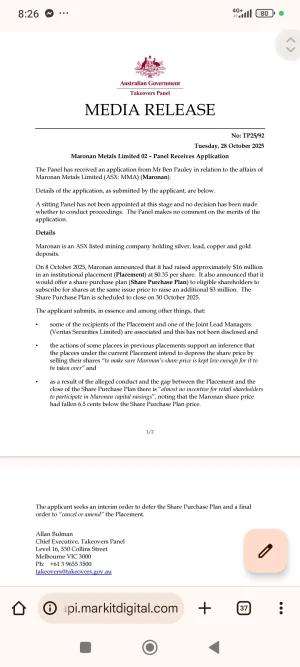

- Dec 2022 – A$121m Two-Tranche Placement: Canaccord Genuity acted as a Joint Lead Manager for Arafura.

- Dec 2023 – A$30m Placement: Canaccord Genuity acted as a Joint Lead Manager for both the institutional placement and SPP.

- July 2024 – A$20m Placement: Canaccord Genuity served as a Joint Lead Manager for a two-tranche placement for Arafura.

Now apparently Canaccord Genuity has “Chinese walls” in place to ensure the integrity of its business. Well who is on each board? Hang on, there is zero public information about these separate boards? Maybe because they don’t have them?

In addition, during some of the capital raises, Canaccord Genuity had a SELL/OUTPERFORM rating for ARU. Our own arrangers telling people to sell. It may be legal...maybe....but why keep employing them. If i was any company looking to raise equity....Canaccord Genuity would be at the bottom of the list based on what we have seen on ARU. And ARU management should bequestioned as well. Why do they put up with this?

This is all very fishy.

And when we run it past lawyers, they all run to the hills, because they all have clients that are doing the same thing on other stocks.

What do others think? Have others seen manipulative trading on ARU? Or any other rare earth stock?