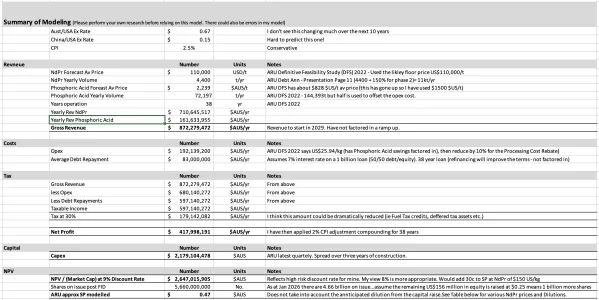

The following is a rough model for Arafura. Please do your own analysis and don't rely on my work. There could be mistakes.

So the model uses:

- Discounted cash flow analysis

- Provides an NPV which is then used as the Market Cap

- Share on issues is estiamted as per the notes (5.66 billion)

So at NdPr volume at 4,400 (Phase 1) i think the ARU SP should be about AUS $0.50. That is the "fair value" based on the assumptions above.

When i change the volume to 11,000 (Phase 2) (also need to adjust the Phosphoric Acid) and it takes phase 2 about three years to build (after Phase 1 is built) i get the SP to be about AUS $1.60. Also assumes no more capital required (ie uses the contingency savings from Phase 1 and some cash flows (minor)).

So in summary

- Phase 1 i value ARU at AUS $0.50

- Phase 2 i value ARU at AUS $1.60

This does not include:

- any HREE sales (i think in the short term will be minor)

- The additional US$300 million from USA Govt....or the revenue from this? It could just fund the Phase 2?

- tolling arrangements (this would just add to the bottom line - ie any additional capex/opex would be bourne by the counter party...and we just take margin)

- the deposit is still open at depth...so we could potentially do more than 11,000 tpa.

- I think there are massive savings in operations, tax etc...that will improve the economics. I just made broad assumptions.

All of these points above will add value to the "fair price"...... and should push the SP higher.

Two more things to add in regards to the ARU SP:

- FIRST - NdPr prices have been modelled with a Price Floor (US$110 per kg)....ARU may be able to achieve higher pricing. A VERY rough approx is...for every US$10 per kg NdPr goes up....adds about AUS$ 0.07 cents to the ARU fair value SP. So as an example..if NdPr goes to US$160 per kg (an extra $50)....the ARU SP would be about AUS $0.90. So ARU SP is highly sensitive to NdPr pricing. And remember...NdPr has hit US$220 per kg previously.

- SECOND - don't forget to add in the FOMO effect. Have a look at MP Materials. I did the same type of NPV analysis...and the BEST SP i could get for MP was about $20...then add in some things that might happen...i could get to about $40-50 per share...and I sold at $87...and the SP hit $97 per share....So watch out for the FOMO effect with ARU finally getting FID.

Remember - the above is not advice...do your own analysis.

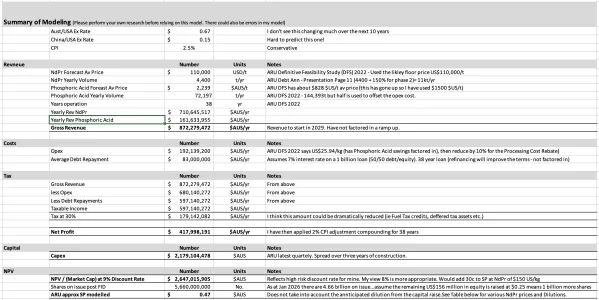

So the model uses:

- Discounted cash flow analysis

- Provides an NPV which is then used as the Market Cap

- Share on issues is estiamted as per the notes (5.66 billion)

So at NdPr volume at 4,400 (Phase 1) i think the ARU SP should be about AUS $0.50. That is the "fair value" based on the assumptions above.

When i change the volume to 11,000 (Phase 2) (also need to adjust the Phosphoric Acid) and it takes phase 2 about three years to build (after Phase 1 is built) i get the SP to be about AUS $1.60. Also assumes no more capital required (ie uses the contingency savings from Phase 1 and some cash flows (minor)).

So in summary

- Phase 1 i value ARU at AUS $0.50

- Phase 2 i value ARU at AUS $1.60

This does not include:

- any HREE sales (i think in the short term will be minor)

- The additional US$300 million from USA Govt....or the revenue from this? It could just fund the Phase 2?

- tolling arrangements (this would just add to the bottom line - ie any additional capex/opex would be bourne by the counter party...and we just take margin)

- the deposit is still open at depth...so we could potentially do more than 11,000 tpa.

- I think there are massive savings in operations, tax etc...that will improve the economics. I just made broad assumptions.

All of these points above will add value to the "fair price"...... and should push the SP higher.

Two more things to add in regards to the ARU SP:

- FIRST - NdPr prices have been modelled with a Price Floor (US$110 per kg)....ARU may be able to achieve higher pricing. A VERY rough approx is...for every US$10 per kg NdPr goes up....adds about AUS$ 0.07 cents to the ARU fair value SP. So as an example..if NdPr goes to US$160 per kg (an extra $50)....the ARU SP would be about AUS $0.90. So ARU SP is highly sensitive to NdPr pricing. And remember...NdPr has hit US$220 per kg previously.

- SECOND - don't forget to add in the FOMO effect. Have a look at MP Materials. I did the same type of NPV analysis...and the BEST SP i could get for MP was about $20...then add in some things that might happen...i could get to about $40-50 per share...and I sold at $87...and the SP hit $97 per share....So watch out for the FOMO effect with ARU finally getting FID.

Remember - the above is not advice...do your own analysis.