Rare Earth ETF Pure Play

Sounds good, right? I know, there are a few out there, but maybe you don’t want to invest anymore in China than you have already by shopping at WalMart or Amazon.

So, how about Western Rare Earth ETF, or Non-Brics ETF? Do we stick to profitable companies only? Ok, wait - do we include those profitable companies whose profit is from commodity mining and are dabbling in or “pivoting” to rare earths? Ok, wait- I think there are already plenty of mining and materials funds that do that.

What I wish for but does not exist is the All-American Rare Earth and Critical Mineral Farm-to-Table ( oops, Mine-to-Magnet) Fund. To qualify, a company must be a): publicly traded, b): make no money, c): have no product marketable within the western hemisphere, d): have no logistics plan in place to to deliver hypothetical products to theorized supply chain partners and most critically, e): have a really great story in light of the above.

In keeping with ETF tradition of low management fees I humbly suggest using the time-tested (insider) Monkey Throwing Darts Model, or alternatively, the intrinsically scientific Zacks Motley Cramer Algore-ithm.

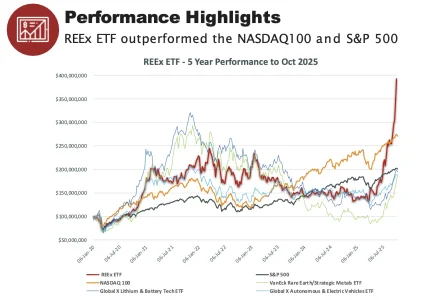

While awaiting these developments I’ll listen to the great folks here at REEx

Sounds good, right? I know, there are a few out there, but maybe you don’t want to invest anymore in China than you have already by shopping at WalMart or Amazon.

So, how about Western Rare Earth ETF, or Non-Brics ETF? Do we stick to profitable companies only? Ok, wait - do we include those profitable companies whose profit is from commodity mining and are dabbling in or “pivoting” to rare earths? Ok, wait- I think there are already plenty of mining and materials funds that do that.

What I wish for but does not exist is the All-American Rare Earth and Critical Mineral Farm-to-Table ( oops, Mine-to-Magnet) Fund. To qualify, a company must be a): publicly traded, b): make no money, c): have no product marketable within the western hemisphere, d): have no logistics plan in place to to deliver hypothetical products to theorized supply chain partners and most critically, e): have a really great story in light of the above.

In keeping with ETF tradition of low management fees I humbly suggest using the time-tested (insider) Monkey Throwing Darts Model, or alternatively, the intrinsically scientific Zacks Motley Cramer Algore-ithm.

While awaiting these developments I’ll listen to the great folks here at REEx