Before reading this, please note this is my own work, may contain errors and may not be relied upon. And it not advice!

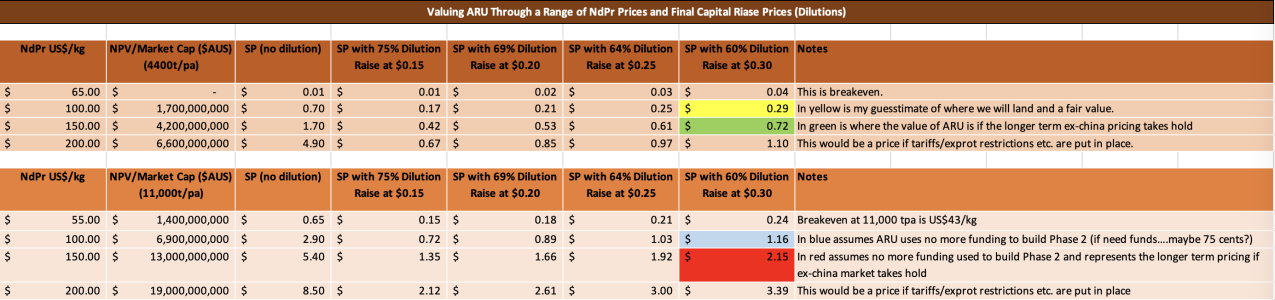

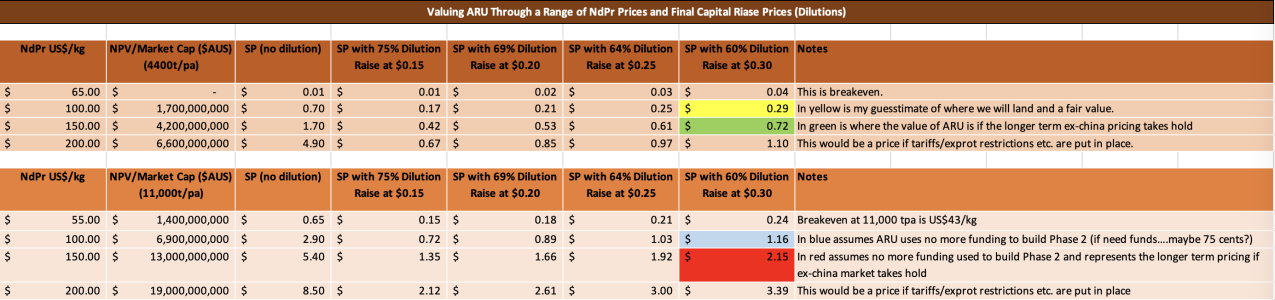

So this table is something I developed and use to look at a range of valuations for ARU and the effect of the Final Capital Riase price (and the dilution that results).

1. Valuing ARU

The following are the scenarios used to value ARU:

Some points to note from my modelling:

2. The Final Capital Raise

The other part of the table shows the dilution effect on the ARU Share Price under different Final Capital Raise prices (15, 20, 25 and 30 cents).

Some points to note:

3. Conclusions

Have others on this forum done any valuations of ARU?

So this table is something I developed and use to look at a range of valuations for ARU and the effect of the Final Capital Riase price (and the dilution that results).

1. Valuing ARU

The following are the scenarios used to value ARU:

- Four NdPr Pricing scenarios (break even, $100, $150 and $200 US per kg); and

- Two production volumes – Phase 1 (4,400 tpa) and Phase 2 (11,000 tpa).

Some points to note from my modelling:

- ARU operating costs:

- ARU has a very low operating cost at about AUS$35-40 per kg (plus there are some tax credits potentially which will further reduce this). But we have to also add in all the financing costs….so that is why from my very coarse model AUS$65 is the break even. Now with some good tax advice, not using all the contingencies etc etc….i can see the breakeven price being well below AUS$65.

- The breakeven price reduces for Phase 2 because the fixed costs are spread over more volume. But again, I think AUS$55 if very conservative and it would likely be much lower.

- NdPr Pricing - The four NdPr prices are shown. But there could be pricing much higher if tariffs are actually applied, war breaks out etc. etc. China is controlling the NdPr price. We all know that. But they have also been careful not to allow it to go too high again, like they did with Japan back in late 2010. But if the west actually wants an NdPr oxide produced outside of China, they will have to pay extra. And if Governments actually enforce these tariffs or other measures….then even US$200 per kg might be low.

- Phase 2 – The ARU CEO has said this publicly many times, that given Phase 1 has massive contingencies (which the Finance parties have required) and that there has been so much work done on the FEED and planning/design/costings, he believes there will sufficient savings from the Phase 1 contingencies, and with approval from the lenders, those monies could be applied to Phase 2, and some of the revenues from the sale of the Phase 1 product (again with some approvals to push back some of the repayments). What does this all mean? Well it means no more capital raises for Phase 2 and no more dilution. Which means any shares bought now/Phase 1 means no more dilution…and the revenue per share goes up massively. Yep there are risks to Phase 2 (like cost over runs, NdPr prices dropping etc)….but this is massive and not yet factored into the ARU share price.

2. The Final Capital Raise

The other part of the table shows the dilution effect on the ARU Share Price under different Final Capital Raise prices (15, 20, 25 and 30 cents).

Some points to note:

- When Hancock Prospecting (Gina) bought in, they did so at 37 cents. The reason I say this, is that Gina saw value at this price.

- There is likely to be different Final Capital Raise prices paid between the Institutional Side and the Retail holders. This is due to the ASX listing rules that mean that retail cannot pay over the blended recent historical prices (there is some wriggle room here…but not much). And given the last 6 months the ARU SP has been very low…I would expect the retail SPP be around 15 cents? Maybe up to 20 cents? HOWEVER, if management have been looking after existing shareholders (as they are legally required to do), then the institutions should be paying a lot higher. I would expect the Institutional price paid per share to be about 25-35 cents. Even better if it is higher!

- Given all the recent issues with Trump, China, Tariffs, Rare Earth restrictions on some products and IP etc. etc…..this should have given ARU management the advantage in negotiations. And could also explain some of the extra time taken to get to FID. So maybe they have been able to raise higher.

- I will always write this – the most dilutive things that have happened to ARU have been the last two capital raises (they could have done one large one at 70 cents) and the games the shorters have played manipulating the ARU Share Price down (see my other post on this). I believe the Chairman of ARU is responsible for this disgusting dilution events happening on multiple occasions.

3. Conclusions

- From a fair value perspective (i.e. if the market rationally invests), there is good money to be made on ARU in my opinion from current SP levels.

- It is my opinion that with all the global events going on in the world, the ARU share price could go much higher than fair value.

- I think once FID is achieved, there should be a substantial bump in SP due to other funds, family offices and retail who only invest in fully financed mines (i.e. they don’t invest before).

- I think during construction we need to keep a close eye on costs, commissioning and ramp up. May present trading opportunities.

Have others on this forum done any valuations of ARU?