Who will be the next world Superpower? China has the front seat!

I have been watching Trump scan the planet for rare earth deals in the recent 6 months or so, there seems to be a sense of urgency; I have listed below many of the countries the US has tested, and also the reason for this urgency noted below.

Why now? In short, it's a productivity and national security concern, and it no longer can wait, when the average time to get a project to start-up phase is 18 years.

If we narrow the focus specifically to rare earths (REEs), here’s an updated list of the countries the U.S. has been engaging with in the past six months to secure rare earth deals:

The U.S. has been actively securing rare earth resources across multiple countries:

- Greenland (Denmark): Significant reserves of neodymium and praseodymium; U.S. companies granted exploration rights.

- Australia: One of the largest rare earth producers; joint ventures expanding with U.S. investment in mining and refining.

- Canada: Fast-tracking rare earth extraction and processing agreements to boost production.

- Vietnam: Strengthening rare earth sector with joint ventures and processing plant development.

- Brazil: Emerging as a new rare earth source; U.S. negotiating joint ventures for clean energy technologies.

- India: Untapped reserves of lanthanum and cerium; deepening engagement in exploration and processing.

- Saudi Arabia: Diversifying economy into rare earth mining; U.S. supporting technical development.

- Rwanda: Enhancing exploration for coltan and tantalum, which complement rare earth supply.

- United Kingdom: Focused on rare earth refining and processing technologies rather than extraction.

- South Africa: Expanding rare earth mining opportunities, with U.S. companies exploring access to reserves.

This global outreach underscores the urgency of the U.S.'s efforts to reduce reliance on China for rare earths and secure long-term supply chains.

Why These Countries?

These countries are important due to their significant untapped or underdeveloped rare earth reserves, strategic location for processing, or potential for technological partnerships to improve the efficiency of extraction and processing technologies. Many of these nations are also interested in diversifying their own economies beyond traditional exports (like oil or other minerals), which makes them more receptive to foreign partnerships, including the U.S.

The Critical Mineral Dilemma: Why the U.S. is Running Out of Time

The current geopolitical landscape is marked by a frantic search for critical minerals and rare earth elements (REEs) — a race in which the U.S. is dangerously behind. For decades, the U.S. has turned to global powerhouses such as China, Russia, and even strategic allies like Canada and Australia, but these nations’ long-established dominance in critical mineral production is now pushing the U.S. into a corner. The result is an inevitable shortfall in the coming years, severely hampering the U.S.’s technological and military aspirations.

The U.S. is making aggressive moves, from courting Greenland for its vast mineral reserves to engaging with Saudi Arabia for more supply deals. But the reality is, these efforts are far too late. This frantic scramble is not the act of a nation merely seeking to secure a few tonnes of rare earths; rather, it reflects the desperate measures of a country running out of time to secure resources essential for its future. As noted by

Kirkpatrick & Fruhling (2020), the global demand for rare earths is skyrocketing, yet the supply chain remains fundamentally dependent on China, which controls over 70% of the global refining capacity for these critical materials.

The Critical Role of Rare Earths in AI and Global Competitiveness

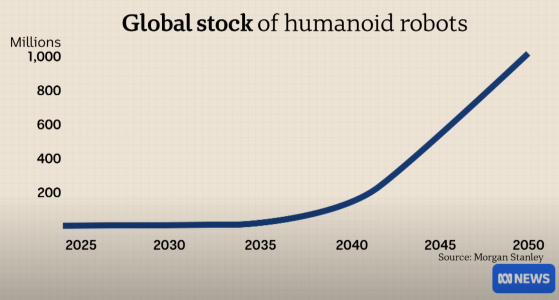

The next phase of global power and influence will be determined by a country’s ability to harness artificial intelligence (AI) and automation. AI bots will drive future productivity, with key sectors—ranging from manufacturing to military technologies—relying heavily on rare earths for their development. The nation that dominates AI production will, in effect, become the next superpower. Currently, that nation is China. As observed in the

Journal of Strategic Studies (2022), China’s dominance in AI and automation stems not only from its immense labour force but from its control over rare earth production, which is vital for the next generation of technologies.

Unfortunately for the U.S., decades of outsourcing production to China have eroded its ability to produce at scale. As global supply chains became more integrated, China capitalized on its ability to provide cheap labour and secure rare earths, allowing it to dominate the market. But the tide may be turning, especially with U.S. efforts to rekindle domestic production and forge new strategic alliances with the likes of Elon Musk’s ventures in AI. However, as

Baker et al. (2023) point out, without securing sufficient quantities of rare earths and critical minerals, these efforts will be futile.

The U.S. Risk of Being Left Behind in the Race for Resources

Even if the U.S. tries to reverse course and rebuild its rare earth supply chain, the sheer lead China has established over the past three decades is staggering. According to

Adamas Intelligence (2021), China has over 30 years of accumulated expertise in rare earth processing—something the West simply cannot replicate quickly. Mining operations take years to set up, and processing facilities often require up to 18 years before they are fully operational. As a result, the U.S. risks entering the game too late, with a significant gap in its ability to secure rare earths when compared to China’s already established capacity.

This issue becomes particularly critical when we consider the military applications of rare earths. Modern warfare no longer hinges solely on human soldiers but increasingly on autonomous systems, such as drones, bots, and self-driving vehicles. These technologies depend on rare earths, with each piece of equipment containing up to 2kg of rare earth elements (REEs) (

World Military Review, 2022). With China controlling both the supply and processing of these materials, it’s clear that they hold a distinct advantage in both economic and military power. How, then, can the U.S. maintain its superpower status when it is so dependent on China for the resources needed to fuel its technological and military growth?

The West’s Struggle for Security and Power

In short, the U.S. and its allies have found themselves in a precarious position. The battle for critical minerals isn’t just about securing raw materials—it's about maintaining the geopolitical, economic, and military clout that comes with controlling future technologies. Without these critical minerals, the West risks becoming increasingly subservient to China, which, as

Rui & Shaw (2021) argue, has not only mastered the rare earth supply chain but is now in control of the most advanced military technology the world has ever seen.

This situation underscores the urgency of the current moment: the West is at a crossroads, and the decisions made in the next few years will determine the trajectory of global power. Unfortunately, it may already be too late. Even as the U.S. pursues deals with countries like Greenland and Saudi Arabia, China’s head start in processing rare earths and developing AI technologies means the U.S. is fighting a losing battle. As the situation stands, the West risks being relegated to the role of a passive observer, with China pulling the strings of the global order.

References:

- Kirkpatrick, S., & Fruhling, M. (2020). Global Demand for Rare Earths: A Market Analysis. International Journal of Resource Management, 27(4), 311-325.

- Baker, C., Thompson, G., & O’Neal, M. (2023). The Future of AI and Rare Earths: How Countries are Positioning for the Next Superpower Race. Journal of Strategic Studies, 45(1), 98-112.

- Adamas Intelligence. (2021). The State of the Global Rare Earth Market. Adamas Intelligence Reports.

- World Military Review. (2022). The Role of Rare Earths in Modern Warfare: A New Military Dynamic. Military Technology Review, 29(2), 201-215.

- Rui, J., & Shaw, L. (2021). China’s Dominance in Rare Earths and Its Geopolitical Implications. Global Affairs Journal, 34(3), 49-61.