So according the ARU CEO, the Financial Investment Decision (the go/no go decision made by the board) is likely to be ‘around June 2025’. Although, the CEO was also quick to point out they have financial runway to keep operating longer.

What do we know already as of Arpil 2025?

ARU has made significant progress in securing debt and equity financing, as well as establishing offtake agreements for its Nolans Project.

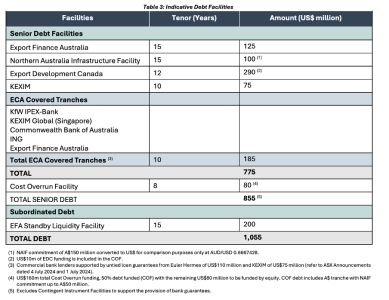

Debt Financing:

In July 2024, Arafura secured a debt package totalling US$775 million (approximately A$1.167 billion). This funding was supported by export credit agencies from Canada, Germany, and South Korea, along with commitments from commercial lenders.

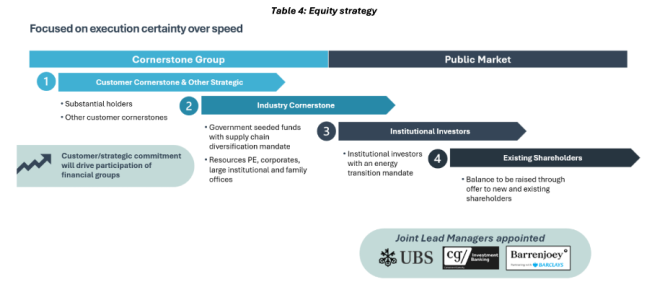

Equity Financing:

ARU aims to raise A$1.2 billion through equity. In February 2025, the Australian Commonwealth Government, via the National Reconstruction Fund Corporation (NRFC), committed A$200 million as cornerstone funding for the Nolans Project.

So the equity book build could look something like this:

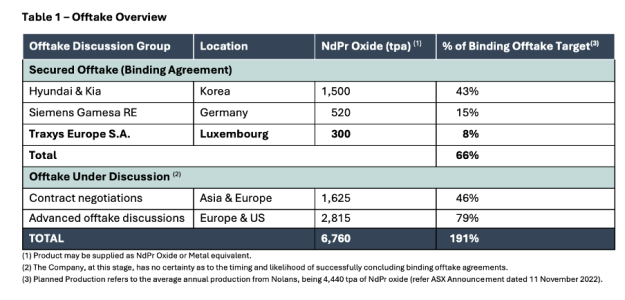

Offtake Agreements:

Arafura has secured multiple offtake agreements to supply Neodymium-Praseodymium (NdPr) oxide from the Nolans Project:

Conclusion on FID:

We seem to be getting to the pointy end. Crunch time. I think with so much Govt support, ARU will get FID achieved this year (I hope there are no delays). When a Govt provides this level of support, they must see it through because otherwise it looks bad to the voters. I think this has de-risked the FID decision.

What do others think about FID timing?

What do we know already as of Arpil 2025?

ARU has made significant progress in securing debt and equity financing, as well as establishing offtake agreements for its Nolans Project.

Debt Financing:

In July 2024, Arafura secured a debt package totalling US$775 million (approximately A$1.167 billion). This funding was supported by export credit agencies from Canada, Germany, and South Korea, along with commitments from commercial lenders.

Equity Financing:

ARU aims to raise A$1.2 billion through equity. In February 2025, the Australian Commonwealth Government, via the National Reconstruction Fund Corporation (NRFC), committed A$200 million as cornerstone funding for the Nolans Project.

So the equity book build could look something like this:

- $200m Australian National Reconstruction Fund Corporation (CONFIRMED)

- $200m Hancock (Corner Stone) (MOST LIKELY)

- $200m POsCO (Hyundai maybe in the mix) (Cornerstone) (FAIRLY LIKELY)

- $200m 2-4 Funds (Guessing one is Australian Super) (UNSURE)

- $200m Retail (Underwritten by XXXX) (FAIRLY LIKELY - They don't have to give retail/exisiting holders shares....)

Offtake Agreements:

Arafura has secured multiple offtake agreements to supply Neodymium-Praseodymium (NdPr) oxide from the Nolans Project:

- Traxys Europe SA: In March 2025, Arafura entered into a binding agreement to supply Traxys with a minimum of 100 tonnes and up to 300 tonnes of NdPr oxide annually over a five-year term.

- Hyundai and Kia: Arafura has established agreements with South Korean automotive manufacturers Hyundai and Kia, further diversifying its customer base and securing demand for its NdPr oxide production. There has been some suggestion that due to the delays, the expiry dates make these non-binding. However, ARU has never said this, and it all its tables for off take, have this as binding.

- Siemens Gamesa Renewable Energy: An offtake agreement has been signed with Siemens Gamesa to supply NdPr rare earths, highlighting Arafura's role in supporting the renewable energy sector.

- Posco?

- USA Dept of Defence?

- GE?

- Well the CEO has said ‘around June 2025’

- Working backwards

- Bucket 4 – Existing Shareholders – This is likely to be a Share Purchase Plan, and these normally take about 4-6 weeks to process. So if 1 July is FID, then working back, the SPP would need to be announced around 15 may 2025.

- I think that Buckets 2 and 3 will all likely fall into the same announcement. They are all waiting on the negotiations between the off take customers who are also putting in equity – Bucket 1. So lets assume there is a 2 week break between SPP and the Bucket 2 & 3 announcements. So lets say 1 May 2025.

- Bucket 1 – Customer Cornerstone and Strategic – this is likely to be Posco and maybe USA DoD. I think for Bucket 2&3 to sign, there are about 6-8 parties, so that might take 2 weeks to get all the signatures etc. So I would assume that we would then hear something around mid April 2025.

- Of course, any of these timelines can be hastened if really required.

- But we should be hearing some Bucket 1 news by the end of April, or the timeline to FID will be too night to achieve by end of June 2025.

Conclusion on FID:

We seem to be getting to the pointy end. Crunch time. I think with so much Govt support, ARU will get FID achieved this year (I hope there are no delays). When a Govt provides this level of support, they must see it through because otherwise it looks bad to the voters. I think this has de-risked the FID decision.

What do others think about FID timing?