https://www.reuters.com/markets/com...liance-imported-critical-minerals-2025-04-15/

Trump has got the USA Commerce Secretary, Howard Lutnick, to begin a national security review of the USA's reliance on imported critical minerals.

Howard Lutnick is a proponent of tariffs. He has even gone so far as to say that tariffs are worth it, even if it leads to a short-term recession.

So given his beliefs we can already deduce the report is likely to say:

If he is reading this post (which I am guessing he is, because we see that most of Washington is reading our website), then can I suggest the following as the investment plan for the Trump administration:

Draft Trump Rare Earth Investment Plan – Make Rare Earths Great Again

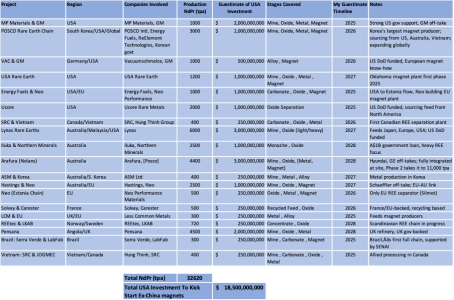

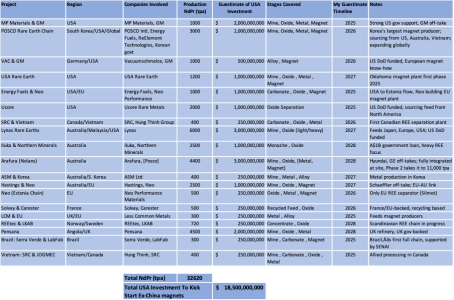

Need to focus on what mines, processors, magnet makers are ready to go.

The following supply chains are already happening, or about to happen. And these should be the focus of direct investment by USA. By this I mean 'Cash Grants'.

$20 billion for the USA Government is nothing.

So why wait 6 months for this report? It is clear what Trump needs to do.

Make Rare Earths Great Again! Spend some money. Make it happen.

Trump has got the USA Commerce Secretary, Howard Lutnick, to begin a national security review of the USA's reliance on imported critical minerals.

Howard Lutnick is a proponent of tariffs. He has even gone so far as to say that tariffs are worth it, even if it leads to a short-term recession.

So given his beliefs we can already deduce the report is likely to say:

- USA should put tariffs on Critical Minerals from China.

- This will build production of these minerals at home or with USA Allies.

- But - if we go to hard too early, China may cut us off completely...and then we are stuffed.

- So we should invest heavily into USA and USA Allies to get the Ex-China critical minerals and supply chains established ASAP.

If he is reading this post (which I am guessing he is, because we see that most of Washington is reading our website), then can I suggest the following as the investment plan for the Trump administration:

Draft Trump Rare Earth Investment Plan – Make Rare Earths Great Again

Need to focus on what mines, processors, magnet makers are ready to go.

The following supply chains are already happening, or about to happen. And these should be the focus of direct investment by USA. By this I mean 'Cash Grants'.

- My quick guestimate would be about $18.5 billion would go a long way to getting most of these projects up and producing in the next 3-5 years.

- Throw another $1 billion at the Universities to ensure there are people educated that can actually design, build, maintain, operate, produce all these rare earths and magnets.

- Add another $0.5 billion for the govt to administer it, and cut through the red tape, permits etc….and for about $20 billion, the Ex-China Rare Earth market and supply chains would be created.

$20 billion for the USA Government is nothing.

So why wait 6 months for this report? It is clear what Trump needs to do.

Make Rare Earths Great Again! Spend some money. Make it happen.