You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Arafura - General Discussion

- Thread starter John

- Start date

Thanks @patarnoster

Yeah interesting report. The rankings are interesting. It is a 'selected rankings'....which seems a bit strange...I'm trying to translate it to understand...but not having much success.

Yeah interesting report. The rankings are interesting. It is a 'selected rankings'....which seems a bit strange...I'm trying to translate it to understand...but not having much success.

Even without robots....there will be massive demand increase...and China and Ex-China supply will need to expand to meet that demand.

I just don't understand why it takes these ARU equity people so long to commit....given what is about to unfold? Do they need to be a rare earth crisis before they commit?

Maybe we should be targeting VC funding?

https://a16z.com/its-time-to-mine-securing-critical-minerals/

The largest VC fund in the world talking about it.....

EddyMoney87

Member

This interview was also posted on HC

Thanks @EddyMoney87

Sorry for the slow reply. I have been on holidays. Back now.

Yeah some interesting insights into ARU and DC. Def worth a watch.

Also amazing just how many people ARU will need to employ in a short amount of time. Hence the ramp up. I think they have given themselves 3 months to ramp up to begin construction.

Sorry for the slow reply. I have been on holidays. Back now.

Yeah some interesting insights into ARU and DC. Def worth a watch.

Also amazing just how many people ARU will need to employ in a short amount of time. Hence the ramp up. I think they have given themselves 3 months to ramp up to begin construction.

EddyMoney87

Member

Northern Territory's role in new US rare earth minerals revealed

The Northern Territory's massive rare earth deposits have suddenly become the linchpin of a $2 billion US-Australia plan to dominate critical minerals production.

The Nolans Bore Rare Earths Project, supported by the Australian Government’s Northern Australia Infrastructure Facility (NAIF), is a significant rare earth development combining mining and refining. The Albanese Government’s expansion of the NAIF and establishment of a Critical Minerals Strategic Reserve aim to strengthen national supply security and support industries from renewable energy to advanced defense manufacturing. The Northern Territory’s resources and government support position it as a key player in the global economy and a crucial link in the supply chain for critical minerals.

The Northern Territory's massive rare earth deposits have suddenly become the linchpin of a $2 billion US-Australia plan to dominate critical minerals production.

The Nolans Bore Rare Earths Project, supported by the Australian Government’s Northern Australia Infrastructure Facility (NAIF), is a significant rare earth development combining mining and refining. The Albanese Government’s expansion of the NAIF and establishment of a Critical Minerals Strategic Reserve aim to strengthen national supply security and support industries from renewable energy to advanced defense manufacturing. The Northern Territory’s resources and government support position it as a key player in the global economy and a crucial link in the supply chain for critical minerals.

EddyMoney87

Member

A one-year reprieve from Chinese rare earth blackmail

Weekend talks eased tensions, but deep mistrust will continue to define the relationship.

The announced “framework” for an agreement sounds more like a temporary truce than a full reconciliation, let alone anything approaching a grand bargain that redefines the relationship between the world’s two largest economies.

The Chinese were notably less specific about the outcome of the Kuala Lumpur talks. Even if this is merely a truce, that is still good news. Markets will welcome any stability and certainty they can get, however tentative and limited.

Weekend talks eased tensions, but deep mistrust will continue to define the relationship.

The announced “framework” for an agreement sounds more like a temporary truce than a full reconciliation, let alone anything approaching a grand bargain that redefines the relationship between the world’s two largest economies.

The Chinese were notably less specific about the outcome of the Kuala Lumpur talks. Even if this is merely a truce, that is still good news. Markets will welcome any stability and certainty they can get, however tentative and limited.

patarnoster

Active member

A one-year reprieve from Chinese rare earth blackmail

Weekend talks eased tensions, but deep mistrust will continue to define the relationship.

The announced “framework” for an agreement sounds more like a temporary truce than a full reconciliation, let alone anything approaching a grand bargain that redefines the relationship between the world’s two largest economies.

The Chinese were notably less specific about the outcome of the Kuala Lumpur talks. Even if this is merely a truce, that is still good news. Markets will welcome any stability and certainty they can get, however tentative and limited.

Another half measure, gives time to build out a supply chain.

EddyMoney87

Member

China knows that one year’s time is nothing in Rare Earth. There will not be a sufficient supply built up. Each party will just pay itself some more time with this move. Like in the article, the Chinese delegation did not tell too much towards the public; the great leader has to decide at the end, like in the US. We will see who this unfolds. In the long run, the West has to diversify, and I hope one of the mines vital for this is ARU.

The deal is done with the USA, and so far I see it is only with the US — guess Europe has also to do something.

The deal is done with the USA, and so far I see it is only with the US — guess Europe has also to do something.

Andrew Ratcliffe

New member

I'm glad the trade tensions have eased. That may cause a short dip in SP. But if the economy collapses the SP would suffer much more in the long run and so would all of us. I sold my OTC shares at .27 a little while back. Not at the peak of the US market but I did well. Just brought back in even more shares at 23 cents.

I guess the question is can Cazzubo secure the last of the necessary capital before the end of the calendar year like he hopes?

400 million? Do we still suspect a JV? Will Rio Tinto or Freeport come in like a deus ex machina and fix everything?

I guess the question is can Cazzubo secure the last of the necessary capital before the end of the calendar year like he hopes?

400 million? Do we still suspect a JV? Will Rio Tinto or Freeport come in like a deus ex machina and fix everything?

EddyMoney87

Member

Latest US-China Trade Truce Leaves Fundamental Issues Unresolved

“China’s never going to give up its leverage on rare earths,” said Dexter Roberts, a nonresident senior fellow at the Atlantic Council’s Global China Hub. “That would be sheer stupidity on their part.”

“China’s never going to give up its leverage on rare earths,” said Dexter Roberts, a nonresident senior fellow at the Atlantic Council’s Global China Hub. “That would be sheer stupidity on their part.”

China will likley just draw this out for as long as they can. And with increasing demand for RE/magnets coming globally, they will probably just supply themselves...leaving ex-China exposed. But by then ex-china supply should be online.

China are looking at the next market to dominate. Digital currency. THey are starting to make all the global businesses start to trade in CNY. Then they will look to push it all on their own digital currency...and then push globally.

The RoW needs to be looking forward more....

China are looking at the next market to dominate. Digital currency. THey are starting to make all the global businesses start to trade in CNY. Then they will look to push it all on their own digital currency...and then push globally.

The RoW needs to be looking forward more....

EddyMoney87

Member

Fact Sheet: President Donald J. Trump Strikes Deal on Economic and Trade Relations with China

This historic agreement includes Chinese commitments to:Halt the flow of precursors used to make fentanyl into the United States.

Effectively eliminate China’s current and proposed export controls on rare earth elements and other critical minerals.End Chinese retaliation against U.S. semiconductor manufacturers and other major U.S. companies.Open China’s market to U.S. soybeans and other agricultural exports.

CHINESE ACTIONS:China will suspend the global implementation of the expansive new export controls on rare earths and related measures that it announced on October 9, 2025. China will issue general licenses valid for exports of rare earths, gallium, germanium, antimony, and graphite for the benefit of U.S. end users and their suppliers around the world. The general license means the de facto removal of controls China imposed in April 2025 and October 2022.

Fact Sheet: President Donald J. Trump Strikes Deal on Economic and Trade Relations with China

REBALANCING TRADE WITH CHINA: This week in the Republic of Korea, President Donald J. Trump reached a trade and economic deal with President Xi Jinping ofwww.whitehouse.gov

I find it short term not bullish but it is just pushing the problem to the future if they do not change now.

But this is what Bessent said on CNN

Scott Bessent on Rare Earths:

You’re not bullish enough. -> this post is from Geiger Capital on X

"China has been putting their rare earth plan together for 25 years. The US has been asleep, but now this administration is going to move at warp speed over the next 1-2 years to get out from under this sword."

here also the original from CNN

https://www.cnn.com/2025/11/02/poli...secretary-on-trump-administration-and-tariffs

EddyMoney87

Member

It has been very quiet here for the last week.

With the placement and SPP almost over what could be the next steps??

Here are the next dates

Placement

Settlement of New Shares under the Tranche Two Placement

Thursday, 11 December 2025

Issue, quotation and trading of New Shares under the Tranche Two Placement

Friday, 12 December 2025

SPP

SPP closes Tuesday,

9 December 2025

Announcement of results of SPP and Issue of New Shares issued under SPP

Monday, 15 December 2025

Commencement of trading of New Shares issued under SPP

Wednesday, 17 December 2025

When I look at the share price, which is under the offering price of the SPP, am not sure what to expect. I doubt a good participation - why should I buy shares for a higher price instead of lower in the market? Is there a benefit if I do so??

With the placement and SPP almost over what could be the next steps??

Here are the next dates

Placement

Settlement of New Shares under the Tranche Two Placement

Thursday, 11 December 2025

Issue, quotation and trading of New Shares under the Tranche Two Placement

Friday, 12 December 2025

SPP

SPP closes Tuesday,

9 December 2025

Announcement of results of SPP and Issue of New Shares issued under SPP

Monday, 15 December 2025

Commencement of trading of New Shares issued under SPP

Wednesday, 17 December 2025

When I look at the share price, which is under the offering price of the SPP, am not sure what to expect. I doubt a good participation - why should I buy shares for a higher price instead of lower in the market? Is there a benefit if I do so??

patarnoster

Active member

Very quiet, the dates stretch into Dec... I think ARU was hoping Germany would confirm things before the SPP closes, but here we are.It has been very quiet here for the last week.

With the placement and SPP almost over what could be the next steps??

Here are the next dates

Placement

Settlement of New Shares under the Tranche Two Placement

Thursday, 11 December 2025

Issue, quotation and trading of New Shares under the Tranche Two Placement

Friday, 12 December 2025

SPP

SPP closes Tuesday,

9 December 2025

Announcement of results of SPP and Issue of New Shares issued under SPP

Monday, 15 December 2025

Commencement of trading of New Shares issued under SPP

Wednesday, 17 December 2025

When I look at the share price, which is under the offering price of the SPP, am not sure what to expect. I doubt a good participation - why should I buy shares for a higher price instead of lower in the market? Is there a benefit if I do so??

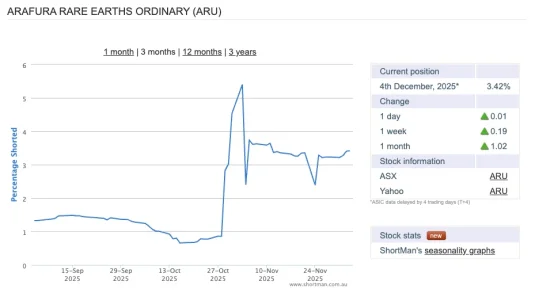

Its likely the SP will fall further, or bump around here, the 28c SPP will be taken up by instos / banks hence the crazy shorting, and I believe there is a specific clause saying so in the SPP details.

The short activity is ridicules, but with this stock it seems to happen every raise.

Broker data tells us the Banks and instos have pulled out and retail in deep, which you will note below as shorts go up, instos / banks go SELL, pretty clear who's shorting and will need to buy shares back.

I look forward to the german funding being confirmed, but I think we still haven't really heard about the Kia/Hyundai bit... its quite small?

With Canada locked in, we Germany hopefully ASAP, they should be able to call FID, unless they need the last offtake %, so thats still needing to be called? Im 90% sure its not required.

So, my view is that BEOT will buy back in, cover shorts when FID is called, I believe they played the news, now are waiting to go from Hype to construction, short the hell out of it until it gets rerated and go long, this should then be taken into the ASX300, when price is floating above 35c (Last time I checked)

Lastly, we also have to contend with the broader market, which tends to provide more red days than green these days.

Thoughts?

I’m not worried about ARU. DC always said Feb 2026. I think Germany needs to fit in with their budget cycle or something like that. Not much we can do.

I would like to know more about the US$300 million. And what they buys us….and what will the returns be. It is obviously additive. So how much should we be putting into our NPV/Market Cap models?

I would like to know more about the US$300 million. And what they buys us….and what will the returns be. It is obviously additive. So how much should we be putting into our NPV/Market Cap models?

Hey @patarnoster

Do we know which fund/bank is shorting us? Hope it’s not anyone involved in the Raise!!

Do we know which fund/bank is shorting us? Hope it’s not anyone involved in the Raise!!

EddyMoney87

Member

I was writting to KfW who is in charge of the Raw Material Fond. But i guess i not get an answer.Very quiet, the dates stretch into Dec... I think ARU was hoping Germany would confirm things before the SPP closes, but here we are.

Its likely the SP will fall further, or bump around here, the 28c SPP will be taken up by instos / banks hence the crazy shorting, and I believe there is a specific clause saying so in the SPP details.

The short activity is ridicules, but with this stock it seems to happen every raise.

View attachment 96

Broker data tells us the Banks and instos have pulled out and retail in deep, which you will note below as shorts go up, instos / banks go SELL, pretty clear who's shorting and will need to buy shares back.

View attachment 97

I look forward to the german funding being confirmed, but I think we still haven't really heard about the Kia/Hyundai bit... its quite small?

With Canada locked in, we Germany hopefully ASAP, they should be able to call FID, unless they need the last offtake %, so thats still needing to be called? Im 90% sure its not required.

So, my view is that BEOT will buy back in, cover shorts when FID is called, I believe they played the news, now are waiting to go from Hype to construction, short the hell out of it until it gets rerated and go long, this should then be taken into the ASX300, when price is floating above 35c (Last time I checked)

Lastly, we also have to contend with the broader market, which tends to provide more red days than green these days.

Thoughts?

Vulcan already got money for Lithium. Wonders me as the Lithium price indicates there must be a lot around.

Anyway i guess this money will come in Feb 2026 the latest.

I am just questioning my self with ARU why should i be staying invested and see the share price declining? I mean who is profiting and why? According to your charts it must be the bank who depress the SP. Why are they doing this - i do not understand?

I was writting to KfW who is in charge of the Raw Material Fond. But i guess i not get an answer.

Vulcan already got money for Lithium. Wonders me as the Lithium price indicates there must be a lot around.

Anyway i guess this money will come in Feb 2026 the latest.

I am just questioning my self with ARU why should i be staying invested and see the share price declining? I mean who is profiting and why? According to your charts it must be the bank who depress the SP. Why are they doing this - i do not understand?

Shaking the tree and getting their last fill before FID?

Who knows. So may games played in the ASX. Makes me sick.

Similar threads

- Replies

- 20

- Views

- 2K

- Replies

- 19

- Views

- 1K

- Replies

- 22

- Views

- 2K