ARU did a presentation at the 2025 Global Metals &Mining Conference.

Here is the link to the presentation - CLICK HERE

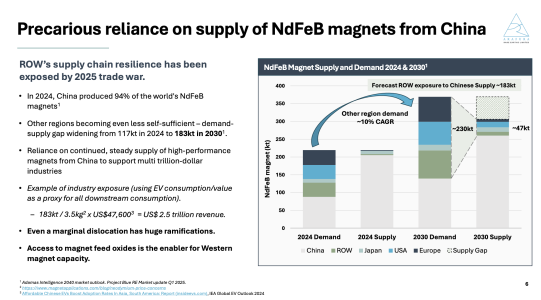

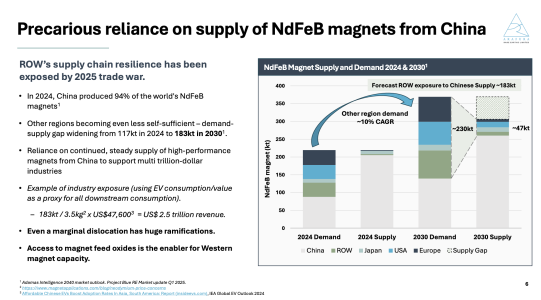

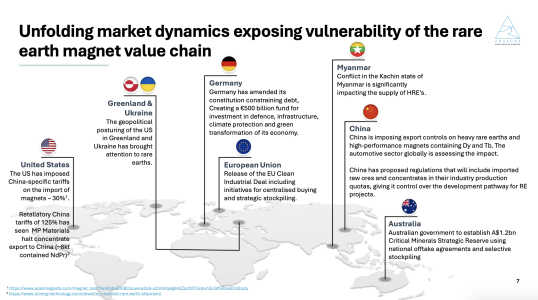

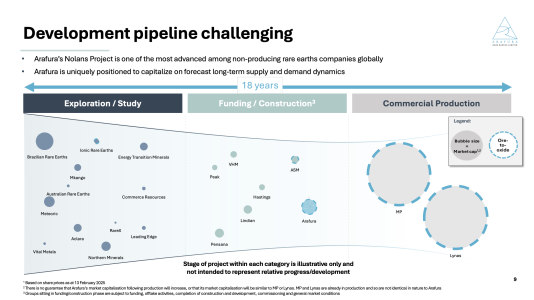

It really is a compelling case for the China/ex-China supply required to meet the demand.

Bascially...even with China and Ex-China brining on lots more supply....won't be able to meet demand.....

Here are the slides:

This accords with some of the modelling i did a year ago. And it is on my list to update.

Anyone got any other insights? Or good links to information on supply and/or demand?

Here is the link to the presentation - CLICK HERE

It really is a compelling case for the China/ex-China supply required to meet the demand.

Bascially...even with China and Ex-China brining on lots more supply....won't be able to meet demand.....

Here are the slides:

This accords with some of the modelling i did a year ago. And it is on my list to update.

Anyone got any other insights? Or good links to information on supply and/or demand?