patarnoster

Active member

Last 6 monthsHey @patarnoster

Do we know which fund/bank is shorting us? Hope it’s not anyone involved in the Raise!!

Last 6 monthsHey @patarnoster

Do we know which fund/bank is shorting us? Hope it’s not anyone involved in the Raise!!

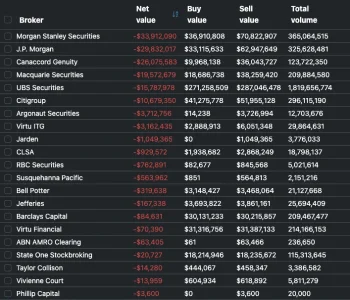

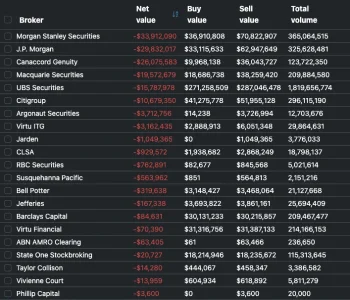

It is, but today is wild,So it is telling that Cannacord made x4 in the last 6 months when ALL the others only x2 their money.

They must be soooo smart with all that inside information. It’s bullshit

ARAFURA on the listHope ARU can profit here and FID is done soon.

Critical Minerals Strategic Reserve sharpens the focus on rare earths

Today’s release of the Association of Mining and Exploration Companies (AMEC) Design

Paper for Australia’s Critical Minerals Strategic Reserve, provides the Australian Government

with a framework to fulfill an election commitment and build on the agreement between

Prime Minister Albanese and President Trump.

Bringing together and working with 10 rare earth developers, AMEC commissioned Mandala

Consulting to optimise a Critical Minerals Strategic Reserve (CMSR), to ensure commercial

bankability, limited tax payer fiscal exposure, and consistency with the Government's policy

objectives.

AMEC has been in discussions with the government since the election promise was made in

April 2025, finalising this paper and providing it to the government in December 2025.

AMEC Chief Executive Officer, Warren Pearce said, “This paper pulls together the expertise

of industry to provide an informed perspective on how best to meet the Government’s plans

for a CMSR.

“The Government went to industry and asked for options and the best practical model for the …

I can't really pin point it....but i just feel something is brewing......

Big changes must be coming at Lynas...why else would their CEO be leaving......

Dunno......something feels like it is about to drop...

A HC thread noted brokers have had a request for peoples names on the register, this tends to be a process before signing a govt contract. This would explain the afternoon crash today with the call going out then, but it may be the finalisation of the equityCertainly something is brewing, could be big, the LYC departure was a surprise, but I think it would be hard to connect it back to ARU… but stranger things have happened and this project is a unicorn in the first place.

Yeah according to a bit of googling, it’s a pre requisite for signing large govt funding.I guess they want to know who they are in bed with yeah? This would be the German Govt?